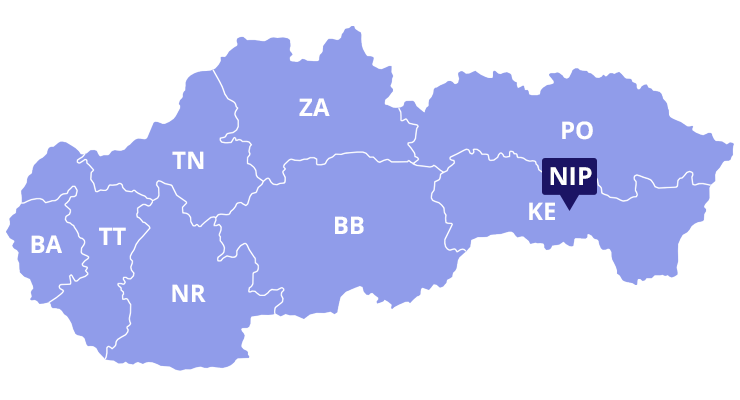

Choose inspectorate

Holiday pay compensation

The employee is entitled to compensation of wages in the amount of his average earnings for the taken leave. For the part of the leave that exceeds four weeks of the basic amount of leave, which the employee could not take until the end of the following calendar year, the employee is entitled to compensation in the amount of his

čítať ďalejWage compensation for difficult work performance

The employee shall be entitled to wage compensation for difficult work performance in the performance of work activities referred to in paragraph 2, if these work activities have been classified by the competent public health authority in category 3 or 4 according to a special regulation, and in their performance organisational and specific protective and preventive measures according to special

čítať ďalejWage benefit for work during public holiday

For work on a public holiday, the employee is entitled to the achieved wage and wage benefits of at least 100% of his average earnings. The wage advantage also belongs to the work performed on a public holiday, which falls on the day of the employee's continuous rest during the week. If the employer and the employee agree to take

čítať ďalejWage benefit for work on Sundays

For work on Sundays, in addition to the wage earned for each hour of work on Saturday, the employee is entitled to a wage discount of at least 100% of the minimum wage in euros per hour according to a special regulation. For an employer who, due to the nature of the work or the conditions of operation, the work

čítať ďalejWage benefit for work on Saturdays

For work on Saturday, in addition to the wage earned for each hour of work on Saturday, the employee is entitled to a wage discount of at least 50% of the minimum wage in euros per hour according to a special regulation. For an employer who, due to the nature of the work or the conditions of operation, the work

čítať ďalejWage benefit for night work

For night work, in addition to the wage achieved for each hour of night work, the employee is entitled to a wage benefit in the amount of at least 40% of the minimum wage in euros per hour according to a special regulation, and if it is an employee performing risky work, he is entitled to a wage benefit in

čítať ďalejWage benefit for overtime work

An employee shall be entitled to wages earned and a wage surcharge equal to at least 25% of his/her average earnings for the performance of overtime work. An employee shall be entitled to wages earned and a wage surcharge equal to at least 35% of his/her average earnings for the performance of risk work. An employer may agree on the

čítať ďalejMinimum wage claims

If employee remuneration is not set by a collective agreement, the employer must pay employees at least the minimum wage set for the degree of work difficulty (hereinafter only “the degree”) of the relevant job. Minimum wage is the basis from which the minimum wage claim for which an employee is entitled depending up the level of the degree allocated

čítať ďalejMinimum wage

The minimum wage is set always for the duration of a calendar year. Below we provide you the minimum monthly and hourly wage for each of the listed calendar years: CALENDAR YEARMIN. MONTHLY WAGEMIN. HOURLY WAGE2025816 €4,690 €2024750 €4,310 €2023700 €4,023 €2022646 €3,713 €2021623 €3,580 €2020580 €3,333 €2019520 €2,989 €2018480 €2,759 €2017435 €2,500 € A wage is a financial settlement or settlement

čítať ďalejNew obligations of employers when posting employees in the field of road transport

Application of Directive (EU) 2020/1057 of the European Parliament and of the Council of 15 July 2020 laying down specific rules in relation to Directive 96/71 / EC and Directive 2014/67 / EU on the posting of drivers in the road transport sector and amending Directive 2006/22 / EC as regards compliance requirements and Regulation (EU) No Regulation (EC) No

čítať ďalej